If you’re receiving or paying child support and also earn income from sex work, you’re not alone-but you might be confused about what you need to tell the courts or child support agencies. The truth is simple: child support is based on your total income, no matter where it comes from. Whether you’re paid in cash, through apps, or via bank transfers, the law treats all income the same when it comes to supporting your children.

Many people assume that because sex work is legally gray in some places, it doesn’t count as income. That’s a dangerous misunderstanding. Child support agencies don’t care if your job is legal, socially accepted, or listed on a tax return. They care about one thing: can you provide for your child? If you’re earning money, they have the right-and the legal power-to include it in your support calculation.

What Counts as Income for Child Support?

Child support formulas don’t list specific jobs. They list types of income. That includes wages, tips, bonuses, rental income, investment returns, freelance payments, and cash earnings. Sex work income falls squarely into the ‘cash earnings’ category. Courts and child support agencies use gross income-what you earn before taxes or deductions-to calculate support payments.

In Australia, where child support is managed by the Child Support Agency (CSA), income is defined as your total assessable income under the Income Tax Assessment Act. That means even if you don’t file a tax return for your sex work earnings, the CSA can still require you to report it. They get data from banks, payment platforms, and even third-party reports. If your bank account shows regular deposits matching the pattern of sex work payments, they’ll ask questions.

Here’s the reality: if you’re earning $800 a week from sex work and not reporting it, you’re not hiding from the system-you’re risking penalties. The CSA can backdate support payments, charge interest, freeze your bank accounts, or even garnish your wages if you’re found to have underreported income.

How Do You Report Sex Work Income?

You don’t need to explain how you earned the money. You only need to report the amount. The process is straightforward:

- Keep records of all income, even cash. Use a notebook, phone app, or spreadsheet. Note the date, amount, and method of payment.

- When you’re asked to submit income details to the CSA or family court, report your total monthly or annual earnings from sex work.

- If you have expenses related to your work (transport, safety gear, cleaning supplies), you can claim them as deductions-but only if you’re filing a tax return. The CSA doesn’t use net income; they use gross. But for tax purposes, deductions matter.

- Be honest. Lying or hiding income can lead to legal consequences, including fines or being held in contempt of court.

Some people think they can avoid reporting by using cryptocurrency or cash-only platforms. That doesn’t work. The CSA has access to financial monitoring tools. They can trace patterns. If you’re receiving $3,000 a month in unexplained cash deposits, they’ll investigate. And if they find you’re hiding income, your child support obligation could be recalculated retroactively-sometimes for years.

What Happens If You Don’t Report?

Not reporting sex work income isn’t a victimless act. It affects your children. If you’re underpaying support because you’re hiding income, your child loses out on food, school supplies, medical care, and stability. And you risk serious legal trouble.

Penalties for hiding income include:

- Back payments with interest (often 10% per year)

- Wage garnishment or bank account freezes

- Loss of driver’s license or passport

- Criminal charges for fraud or contempt of court

In 2024, the Australian CSA recovered over $120 million in unreported income from parents who tried to hide earnings. That included income from gig work, informal labor, and sex work. The agency doesn’t discriminate by job title-they track money.

Can You Get Help Reporting Income?

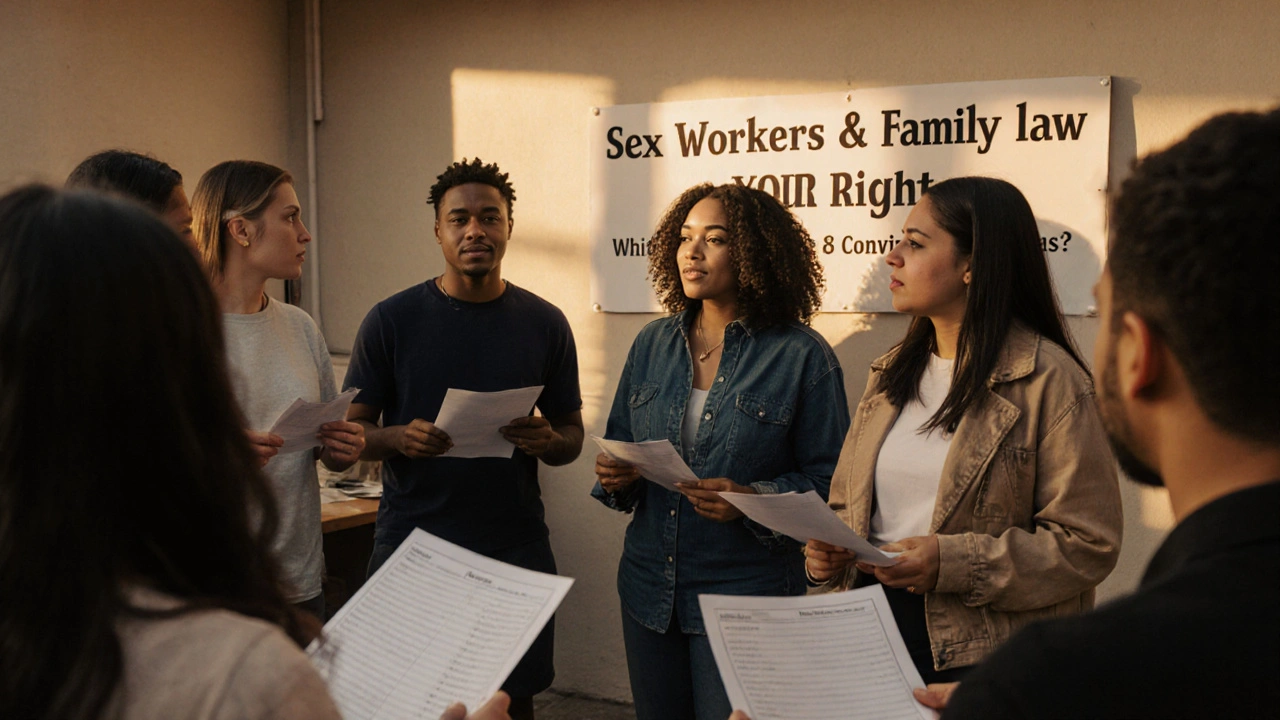

You don’t have to figure this out alone. There are free, confidential services that help people in your situation. Legal Aid offices across Australia offer family law advice for low-income individuals. They won’t judge you. They’ll help you understand your obligations and how to report your income correctly.

Some community organizations, like the Scarlet Alliance or SWOP (Sex Workers Outreach Project), offer legal workshops specifically for sex workers navigating family law. They know the system. They’ve helped people file income statements, negotiate payment plans, and avoid penalties.

Even if you’re scared, reaching out is the safest move. The system is designed to protect children-not to punish adults. When you report your income honestly, you’re not admitting guilt to your job. You’re proving you’re willing to take responsibility for your child.

What If You’re the One Receiving Support?

If you’re the parent receiving child support and you also do sex work, you still need to report your income. Why? Because your earnings can change how much support you get.

Child support isn’t just about what the other parent pays. It’s about total household income. If you’re earning $2,500 a month from sex work, the CSA may reduce the amount the other parent owes-or even stop payments if your income is high enough to fully support the child.

This isn’t punishment. It’s fairness. The system assumes that if you’re earning enough to cover your child’s needs, the other parent shouldn’t pay more than necessary. But if you don’t report your income, you might be missing out on support you’re entitled to.

For example: a single mother in Perth earning $1,200 a month from sex work didn’t report it. She was receiving $400 a month in child support. When the CSA found her income, they recalculated her total household income and reduced her support to $150. She was upset-but she also realized that if she’d reported her income earlier, she could have negotiated a fairer arrangement instead of being caught off guard.

Myths About Sex Work and Child Support

There are a lot of myths floating around. Let’s clear a few:

- Myth: If sex work is illegal, I don’t have to report it.

Truth: Legality doesn’t matter. Income is income. - Myth: Cash payments can’t be tracked.

Truth: Bank deposits, payment apps, and even patterns in your spending can trigger audits. - Myth: Reporting will get me in trouble with the police.

Truth: Child support agencies don’t share income data with law enforcement unless there’s a separate criminal investigation. They’re focused on child welfare, not criminal prosecution. - Myth: I can just say I’m unemployed.

Truth: The CSA can impute income based on your lifestyle, assets, or past earnings. They’ll assume you’re earning what someone in your position normally would.

What You Should Do Now

If you’re unsure about your situation, take these steps:

- Collect 3-6 months of income records from your sex work. Even rough estimates help.

- Contact your local Legal Aid office. Ask for family law advice.

- If you’re already in a child support case, request a review of your income assessment.

- Don’t wait until you’re summoned to court. Proactive honesty gives you control.

It’s not about shame. It’s about stability-for your child and for yourself. When you report your income honestly, you remove the fear of surprise audits, back payments, or legal trouble. You also show your child that you take responsibility seriously, no matter how hard the circumstances.

Final Thought

You don’t need to justify your job to get child support right. You just need to be honest about your income. The system doesn’t ask how you earn money. It only asks: can you provide for your child? If you can, report it. If you’re struggling, ask for help. There are people who’ve been where you are-and they made it through by doing the right thing, not the easy thing.

Do I have to pay taxes on sex work income if I’m paying child support?

Yes. Child support and taxes are separate systems. The Child Support Agency uses your gross income to calculate support, but the Australian Taxation Office (ATO) requires you to declare all income for tax purposes. You can claim work-related expenses (like transport, safety equipment, or phone costs) to reduce your taxable income-but you still must report the full amount earned. Failing to file a tax return can lead to penalties from the ATO, even if you’re reporting income to the CSA.

Can I be jailed for not reporting sex work income for child support?

You won’t go to jail just for not reporting income-but you can be held in contempt of court, which carries the risk of jail time if you repeatedly ignore court orders. Most cases start with fines, wage garnishment, or license suspension. Jail is rare and usually only happens after years of non-compliance or fraud. The system prefers to fix the problem, not punish it.

Will reporting sex work income affect my immigration status?

No. Child support agencies do not share income information with immigration authorities. Your earnings from sex work are only reviewed for the purpose of calculating child support. Unless you’re involved in illegal activities like trafficking or underage work, your income reporting won’t trigger immigration investigations. The CSA’s role is limited to child welfare, not immigration enforcement.

What if I earn income from multiple sources, including sex work?

You must report all income. The CSA calculates child support based on your total annual income from every source-your job, side gigs, investments, and sex work. If you’re unsure how to total it, use a spreadsheet. List each source, monthly amount, and total. The CSA doesn’t care about the source, only the sum. Being organized makes the process smoother and protects you from errors.

Can I negotiate a payment plan if my income is irregular?

Yes. If your sex work income varies month to month, you can ask the CSA to use an average of your earnings over the past 6-12 months. This prevents sudden spikes in payments during busy months. You’ll need to provide records to prove your average income. Many parents in informal work arrangements use this option. It’s common, accepted, and helps keep payments manageable.