Emergency Fund for Sex Workers: How to Build Financial Safety Nets

When you work in sex work, your income isn’t steady, your expenses can spike overnight, and one bad day can wipe out a week’s earnings. That’s why an emergency fund for sex workers, a dedicated cash reserve built specifically to handle sudden financial shocks without risking safety or stability isn’t a luxury—it’s survival. Unlike traditional jobs with paychecks and benefits, sex workers often operate without employer protections, health insurance, or paid time off. If your car breaks down, you get sick, or a client ghosts you after a booking, your emergency fund is the only thing standing between you and crisis.

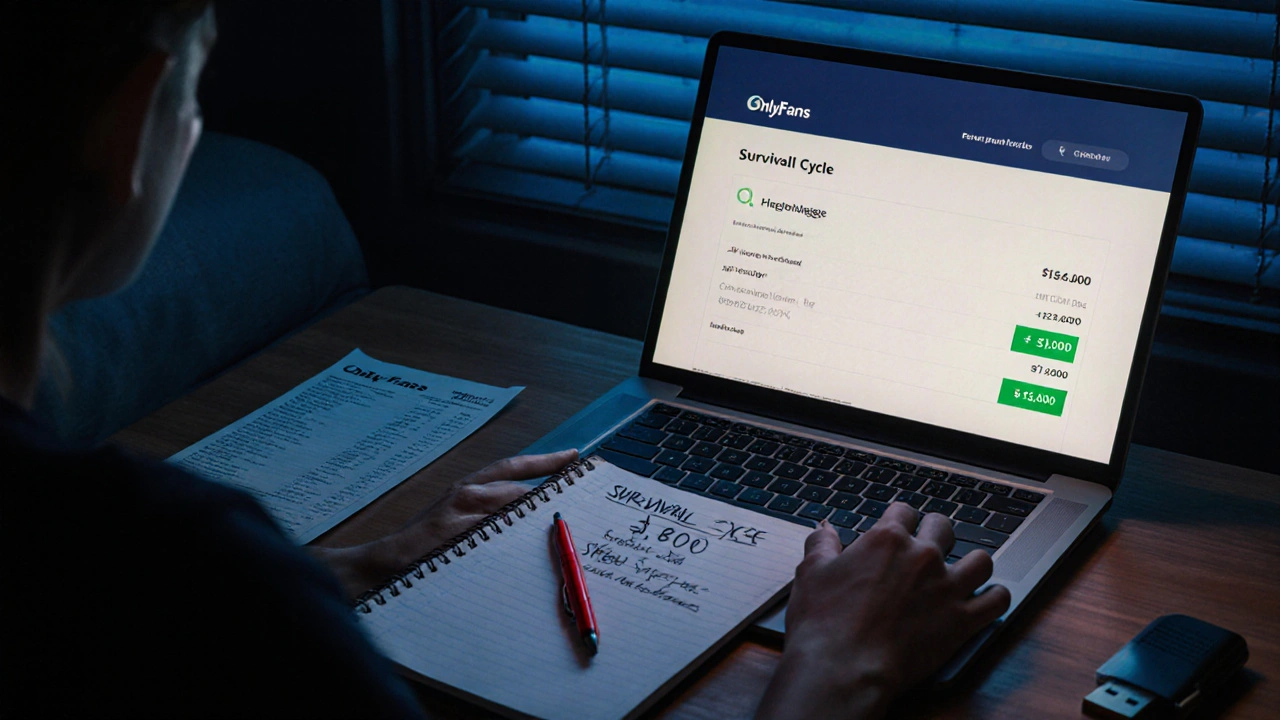

This fund isn’t just about money—it’s about control. It lets you say no to unsafe clients, walk away from exploitative situations, or take time off to heal without panic. Many sex workers use cash envelopes, a physical system where a portion of earnings is set aside in sealed envelopes to avoid digital tracking or bank freezes. Others rely on prepaid debit cards under aliases or crypto wallets to keep funds hidden from landlords, family, or abusive partners. The goal isn’t to hide money from the world—it’s to protect your autonomy. And it’s not just about emergencies. This fund also covers things like safe transportation, legal fees, or even replacing a stolen phone that holds your client list and payment apps.

Building this fund takes discipline, especially when income is unpredictable. Some workers set aside 10% of every payment, no matter how small. Others use apps like Splitwise, a tool often repurposed by sex workers to track income splits and automatically divert portions into a separate savings account—not for splitting bills with friends, but for forcing themselves to save. You don’t need thousands. You need $500. Then $1,000. Then $2,000. Each step gives you more breathing room. And when you have it, you stop making decisions out of fear. You stop taking risks just to pay rent. You stop letting someone else dictate your safety.

What you’ll find below are real, practical stories and tools from sex workers who’ve built these funds under pressure. From how to stash cash without getting caught, to using bad date lists to avoid income loss, to legal documents that protect your earnings—every post here is about keeping your money, your body, and your freedom intact. This isn’t theory. It’s what works when you’re on your own and no one else is coming to help.

- Nov, 22 2025

- 0 Comments

Financial Planning for Sex Workers: Building Emergency Funds and Safety Nets

Financial planning for sex workers means building emergency funds and safety nets to survive income instability, legal risks, and sudden crises. Learn how to save, protect your money, and access support without relying on luck.

read more