Financial Planning for Sex Workers: Budgeting, Safety, and Long-Term Security

When you work in sex work, financial planning, the deliberate process of managing income, expenses, and future goals despite legal and social instability. Also known as income resilience strategy, it's not a luxury—it’s the difference between surviving and thriving. Most people assume financial planning means 401(k)s and stock portfolios, but for sex workers, it’s about building layers of protection: cash reserves, hidden accounts, legal safeguards, and exit strategies. It’s not about hiding money—it’s about keeping yourself safe when the system doesn’t have your back.

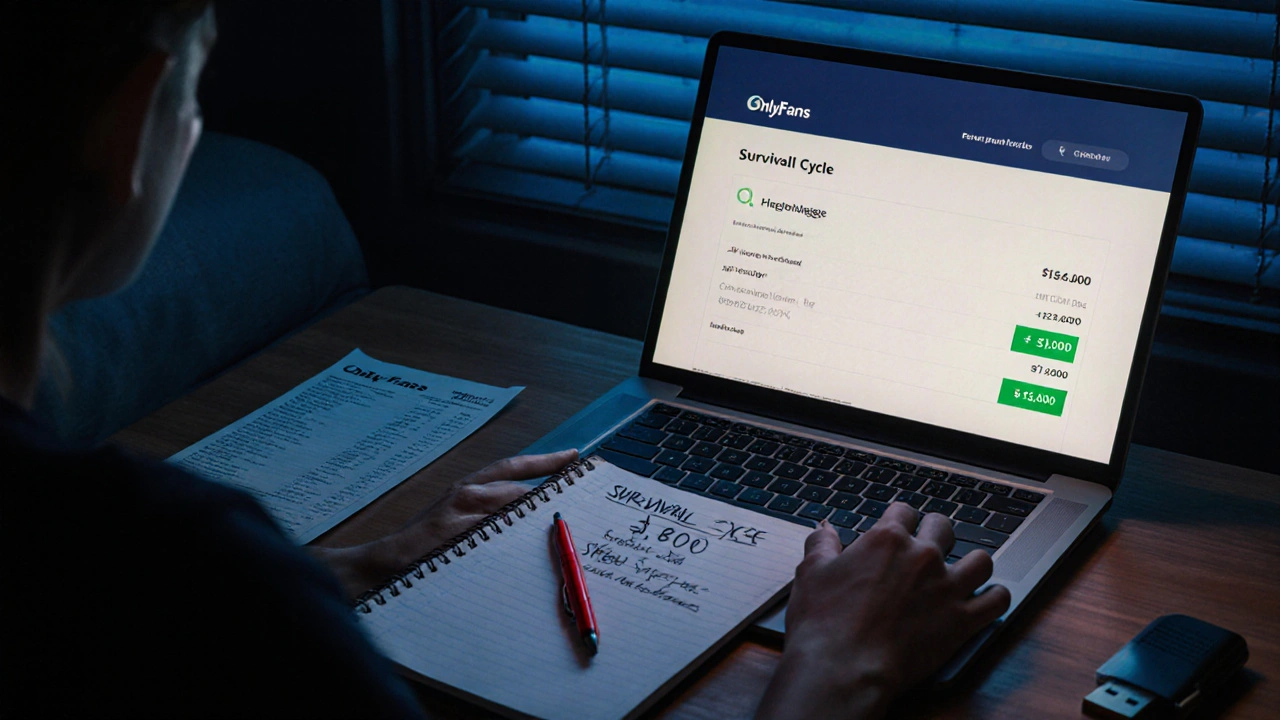

That’s why emergency fund for sex workers, a dedicated, accessible stash of cash meant to cover sudden legal fees, medical costs, or abrupt job loss isn’t optional. One client gets violent. A landlord threatens eviction. A bank freezes your account over a mistaken fraud alert. These aren’t rare events—they’re part of the job. The same goes for sex worker income management, the practice of tracking, separating, and protecting earnings from unpredictable or cash-heavy work. You don’t just need a budget—you need a system that works when your income spikes one week and drops to zero the next. That means using multiple bank accounts, prepaid cards, and digital wallets that don’t tie directly to your real name. Some use crypto. Others use cash envelopes. The goal isn’t to be secretive—it’s to be in control.

And then there’s the long game. sex worker savings, setting aside money over time to fund education, housing, or a career transition is how people leave the industry on their own terms. Not because they had to. Not because they were pushed out. But because they chose to. That’s why so many of the posts here focus on legal documents, transportation safety, and medical escort services—because all of those things cost money, and none of them are covered by insurance or government programs. You’re building your own safety net, one dollar at a time.

You’ll find real strategies here—not theory, not motivational fluff. You’ll see how others set up bank accounts that don’t trigger red flags. How they save for a car when they can’t get a loan. How they plan for mental health care without relying on a system that judges them. How they use legal protections to shield their identity while still paying taxes. This isn’t about becoming rich. It’s about becoming free.

What follows are guides written by people who’ve been there: managing cash flow during police raids, saving for a new apartment after leaving the streets, and setting up retirement accounts that won’t be seized. These aren’t stories of luck. They’re stories of systems. And you can build one too.

- Nov, 22 2025

- 0 Comments

Financial Planning for Sex Workers: Building Emergency Funds and Safety Nets

Financial planning for sex workers means building emergency funds and safety nets to survive income instability, legal risks, and sudden crises. Learn how to save, protect your money, and access support without relying on luck.

read more