Self-Employed Sex Worker: Rights, Safety, and Legal Protection

When you’re a self-employed sex worker, an independent professional providing companionship or sexual services without being employed by a third party. Also known as independent escort, it means you control your schedule, rates, and clients—but you also carry all the risks alone. Unlike employees, you don’t get sick leave, worker’s comp, or legal backing when things go wrong. That’s why knowing your rights isn’t optional—it’s survival.

Many assume sex work is either fully legal or fully criminalized, but the truth is messier. In the UK, selling sex isn’t illegal, but many activities around it—like soliciting in public, running a brothel, or advertising—are. This creates a gray zone where civil forfeiture, the process where police seize cash, cars, or phones without charging you with a crime can wipe out your life savings just because you’re carrying a large amount of cash. One woman in Manchester lost her car and £8,000 in savings after police flagged her bank deposits as "suspicious." No charges. No trial. Just gone. And sex worker health, access to STI testing, PrEP, mental health care, and non-judgmental medical support is often harder to get than housing. Clinics turn you away. GPs make assumptions. You learn to hide symptoms or pay out of pocket.

You’re not alone in this. Thousands of self-employed sex workers use peer networks, encrypted check-ins, and safe housing setups to protect themselves. They know how to screen clients without sounding paranoid, how to document abuse without involving police, and how to fight eviction when landlords find out what they do. These aren’t secrets—they’re survival skills passed down through trusted circles. And they work.

What you’ll find below isn’t theory. It’s real advice from people who’ve been through it: how to lock down your digital life, what to do if you’re threatened, how to get medical transport after surgery, how to handle housing discrimination, and how to use civil law to protect yourself when the police won’t. These aren’t hypotheticals. They’re daily realities for self-employed sex workers across the UK—and you deserve to know how to navigate them safely.

- Nov, 12 2025

- 0 Comments

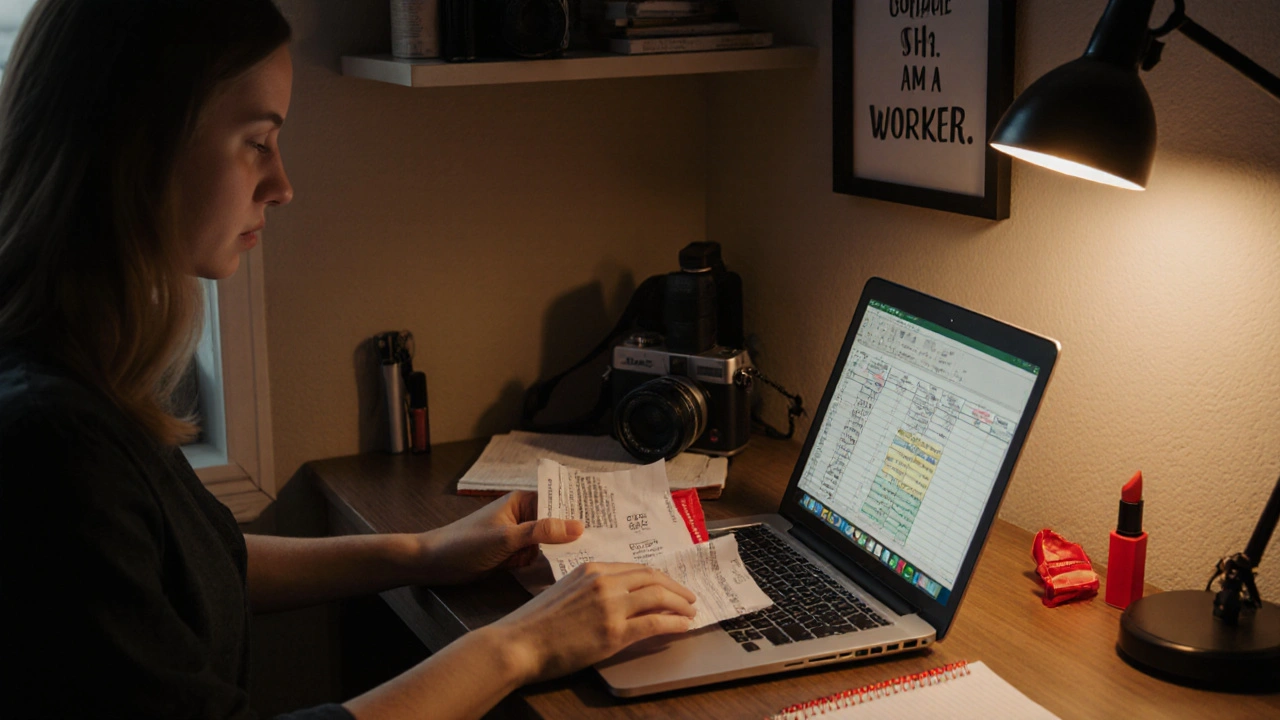

Tax Obligations for Sex Workers: Self-Employment, Deductions, and Records

Sex workers in Australia must declare income and can claim business deductions like any self-employed person. Learn how to track earnings, claim expenses, avoid penalties, and protect your rights with proper records.

read more