Sex Work Financial Safety: Protecting Income, Assets, and Future Stability

When you work in sex work, sex work financial safety, the practice of securing income, assets, and personal data while working in a legally risky environment. Also known as financial protection for sex workers, it’s not a luxury—it’s the difference between staying in control and losing everything to a bank freeze, eviction, or legal trap. Most people assume financial safety means saving money. But for sex workers, it’s about hiding income from systems that don’t recognize your work, keeping your name off public records, and making sure your bank account doesn’t become a liability.

financial privacy for sex workers, the strategies used to prevent financial trails from linking your work to your identity. Also known as anonymous income handling, it includes using prepaid cards, cash-based payment systems, and separate business accounts that don’t trigger red flags. Banks often shut down accounts without warning when they spot recurring payments labeled as "escort" or "companionship." That’s why many sex workers use third-party payment processors that don’t require real names, or split income across multiple methods so no single transaction looks suspicious. safe banking for sex workers, the process of maintaining financial access without exposing your work status. Also known as banking without disclosure, it’s not about fraud—it’s about survival in a system designed to punish you for working. You don’t need to lie to get a bank account. You need to know how to frame your income as freelance consulting, photography, or digital services—legally, safely, and without raising alarms.

And it’s not just about today’s income. sex work legal protection, using legal tools like contracts, confidentiality agreements, and record-sealing to shield your identity and finances. Also known as legal safeguards for sex workers, it includes things like sealing court records after minor charges, using pseudonyms in contracts, and keeping digital footprints minimal. If you’ve ever been pulled over, questioned by police, or had a client threaten to expose you, you know how fast your life can unravel. That’s why preparing legal documents ahead of time—like client agreements, emergency contact forms, and financial power-of-attorney papers—isn’t extra work. It’s your insurance policy.

You’ll find real stories here—not theory. Guides on how to open a bank account after being flagged. How to file taxes without revealing your work. How to move money without triggering fraud alerts. How to build savings when your income is irregular and unpredictable. And how to plan an exit strategy that doesn’t leave you broke and exposed. These aren’t hypotheticals. They’re tools used by sex workers right now to stay safe, stay solvent, and stay in charge of their own lives.

- Nov, 22 2025

- 0 Comments

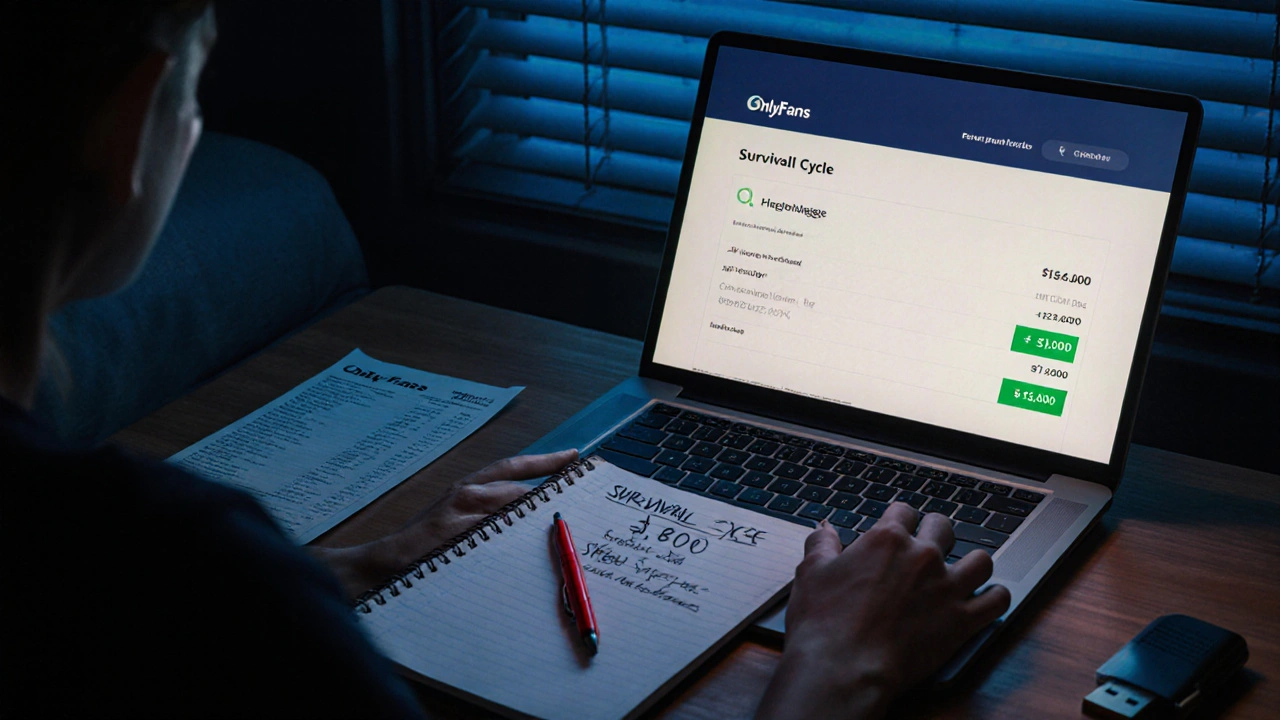

Financial Planning for Sex Workers: Building Emergency Funds and Safety Nets

Financial planning for sex workers means building emergency funds and safety nets to survive income instability, legal risks, and sudden crises. Learn how to save, protect your money, and access support without relying on luck.

read more