Sex Work Income Stability: How Sex Workers Manage Earnings and Financial Safety

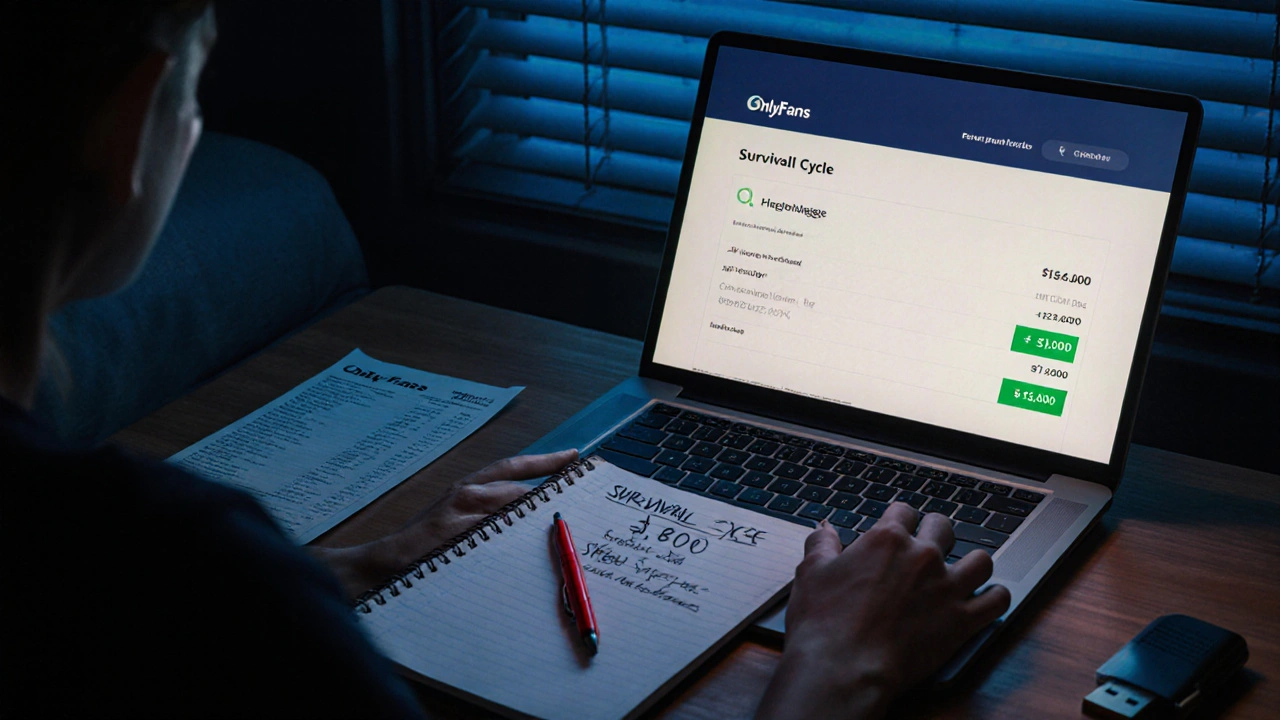

When we talk about sex work income stability, the ability of sex workers to maintain consistent, safe, and predictable earnings despite legal, social, and economic risks. Also known as financial resilience in sex work, it’s not about luck—it’s about strategy, boundaries, and planning. Unlike most jobs, sex workers rarely get paychecks, benefits, or unemployment insurance. Many don’t have bank accounts they can openly use. Some work cash-only. Others rely on digital payments that can get frozen or flagged. Yet, thousands still find ways to build stable incomes—sometimes even saving for homes, education, or exits from the industry.

This stability doesn’t come from waiting for policy changes. It comes from daily choices: keeping separate finances, using trusted payment platforms, tracking income and expenses, and building multiple income streams. Some sex workers supplement their work with freelance gigs, tutoring, or selling handmade goods. Others use savings accounts under a trusted friend’s name or crypto wallets for anonymity. legal protection for sex workers, tools like client agreements, consent forms, and emergency protocols that help reduce financial exploitation and legal vulnerability. Also known as safety contracts, these aren’t just paperwork—they’re financial shields. A client who refuses to pay? A signed agreement can be used in civil court. A sudden arrest? Having documents ready helps lawyers act faster and protects your assets. And when you’re ready to leave the industry, exit planning for sex workers, a structured roadmap to transition out of sex work, including financial reserves, job training, and emotional support networks. Also known as leaving the industry safely, it’s the most under-discussed but vital part of long-term income stability. Many who exit do so without savings, housing, or skills. Those who plan ahead don’t just survive—they rebuild.

It’s not glamorous. It’s not talked about in boardrooms. But the people who make this work know the truth: stability in sex work means controlling what you can—your boundaries, your money, your safety—and letting go of what you can’t. The posts below show real strategies: how to use ride-hailing apps without getting tracked, how to protect your identity in legal cases, how to build emergency funds when your income is unpredictable, and how to move on without starting from zero. This isn’t theory. It’s lived experience. And if you’re trying to make sense of your finances, your safety, or your next step—you’ll find something here that actually helps.

- Nov, 22 2025

- 0 Comments

Financial Planning for Sex Workers: Building Emergency Funds and Safety Nets

Financial planning for sex workers means building emergency funds and safety nets to survive income instability, legal risks, and sudden crises. Learn how to save, protect your money, and access support without relying on luck.

read more