Sex Work Taxes: What You Need to Know About Reporting Income and Avoiding Penalties

When you earn money from sex work, you’re still required to report it to the IRS, the U.S. Internal Revenue Service that collects federal taxes and enforces tax laws. Even if your work is legally gray or stigmatized, the tax code, the set of federal rules governing how income is reported and taxed doesn’t care how you earn your money—it only cares that you report it. Many sex workers avoid filing taxes out of fear, but skipping it puts you at risk for audits, penalties, or worse—asset seizures under civil forfeiture, a legal process where law enforcement can take cash, vehicles, or devices without charging you with a crime. The truth? Filing isn’t about admitting guilt. It’s about protecting yourself.

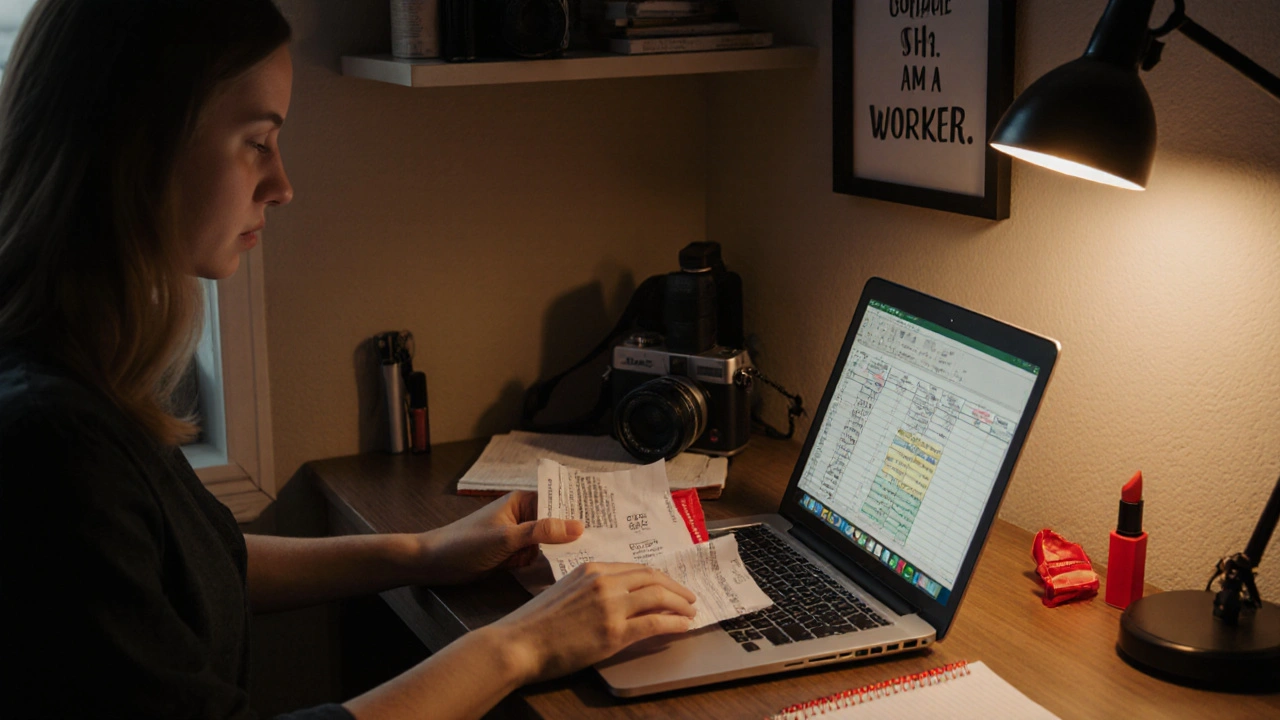

Here’s the reality: you can deduct business expenses just like any other freelancer. Costs for safe housing, digital security tools, transportation, STI testing, phone bills, and even self-defense gear can count as legitimate deductions. You don’t need a fancy accountant—you need clear records. Save receipts, track mileage, log dates and earnings. Apps like Wave or Zoho Invoice are free and simple. The financial safety, the ability to manage money securely without exposing your identity or risking legal consequences you gain from proper tax filing is worth more than the fear of being found out. And if you’re worried about being traced? Use a P.O. box, a business name that doesn’t link to your real identity, and never deposit cash into accounts tied to your name. Many sex workers file as sole proprietors using Schedule C. You’re not alone—thousands do it every year without getting raided.

What you’ll find in this collection aren’t abstract tax tips. These are real, tested strategies from workers who’ve navigated audits, avoided asset seizures, and kept their income private while staying legal. You’ll read about how to document earnings without using traceable payment platforms, how to handle IRS letters without panicking, and why keeping your finances separate from your personal life isn’t just smart—it’s survival. Whether you’re just starting out or have been working for years, these posts give you the tools to stop hiding and start protecting yourself—with or without the system’s approval.

- Nov, 12 2025

- 0 Comments

Tax Obligations for Sex Workers: Self-Employment, Deductions, and Records

Sex workers in Australia must declare income and can claim business deductions like any self-employed person. Learn how to track earnings, claim expenses, avoid penalties, and protect your rights with proper records.

read more