Sex Worker Tax Australia: What You Need to Know About Income, Deductions, and Legal Risks

When you work as a sex worker in Australia, your income is taxable income, any money earned from lawful services must be declared to the Australian Taxation Office. Also known as self-employed income, it’s treated the same as any other freelance or business earnings—whether you work independently, through an agency, or online. The ATO doesn’t care how you earn it, only that you report it. Yet many sex workers avoid filing taxes out of fear—of stigma, of being tracked, of triggering scrutiny from authorities. That fear is real, but so is the risk of not filing: penalties, audits, and even civil forfeiture if your financial activity looks suspicious without proof of legitimate income.

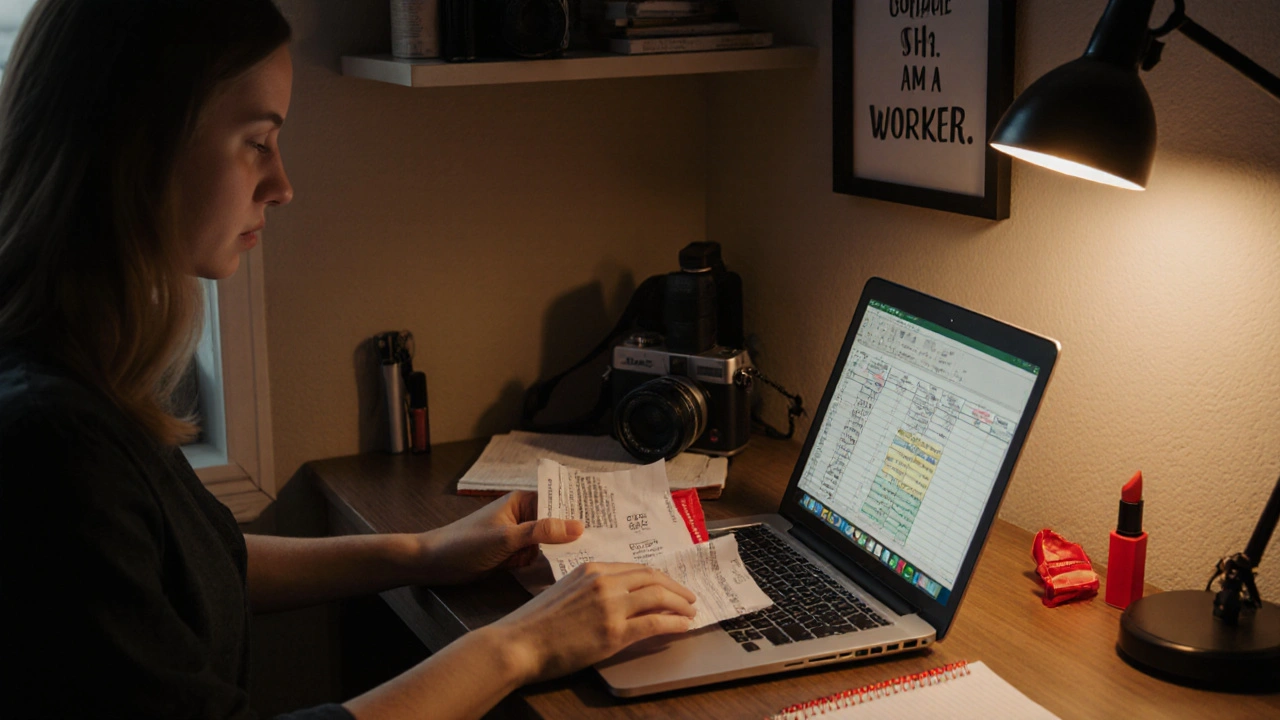

That’s why understanding tax obligations for sex workers, the legal requirement to declare earnings and claim allowable deductions under Australian tax law isn’t just about staying compliant—it’s about protection. You can claim deductions for things like vehicle costs, phone bills, safety gear, advertising, and even home office space if you meet clients there. The ATO allows these, but only if you keep records. Without them, you’re vulnerable. And if you’re using digital payments, crypto, or cash-only systems, that doesn’t make you invisible—it makes your tax position riskier. The ATO uses data matching tools to spot unreported income, and sex workers are often flagged because their income patterns don’t match traditional employment.

There’s also a deeper layer: anti-discrimination protections, legal rights that should prevent banks, landlords, or service providers from denying you services because of your work. But in practice, many sex workers face bank account closures, rental denials, or even being reported to authorities just for filing taxes. That’s why knowing your rights is as important as knowing the tax code. You’re not breaking the law by working—Australia doesn’t criminalize sex work in most states—but you can still be punished for it in hidden ways.

What you’ll find below are real, practical guides written by and for sex workers in Australia. From how to safely document your income without exposing your identity, to which deductions you can claim without triggering red flags, to how to handle bank inquiries without losing your account. These aren’t theoretical tips—they’re battle-tested strategies from people who’ve been audited, denied services, or had their assets seized. You don’t need to be a tax expert to protect yourself. You just need the right information.

- Nov, 12 2025

- 0 Comments

Tax Obligations for Sex Workers: Self-Employment, Deductions, and Records

Sex workers in Australia must declare income and can claim business deductions like any self-employed person. Learn how to track earnings, claim expenses, avoid penalties, and protect your rights with proper records.

read more