Tax Deductions for Sex Workers: What You Can Legally Claim

When you earn money as a sex worker, you’re running a business—whether you work alone, online, or in person. That means you’re eligible for tax deductions for sex workers, legitimate business expenses that reduce your taxable income under UK self-employment rules. Also known as self-employed business expenses, these deductions aren’t special treatment—they’re basic rights for anyone who earns income independently. The UK doesn’t criminalize selling sexual services, so if you’re reporting your income, you’re entitled to claim what you spend to make it.

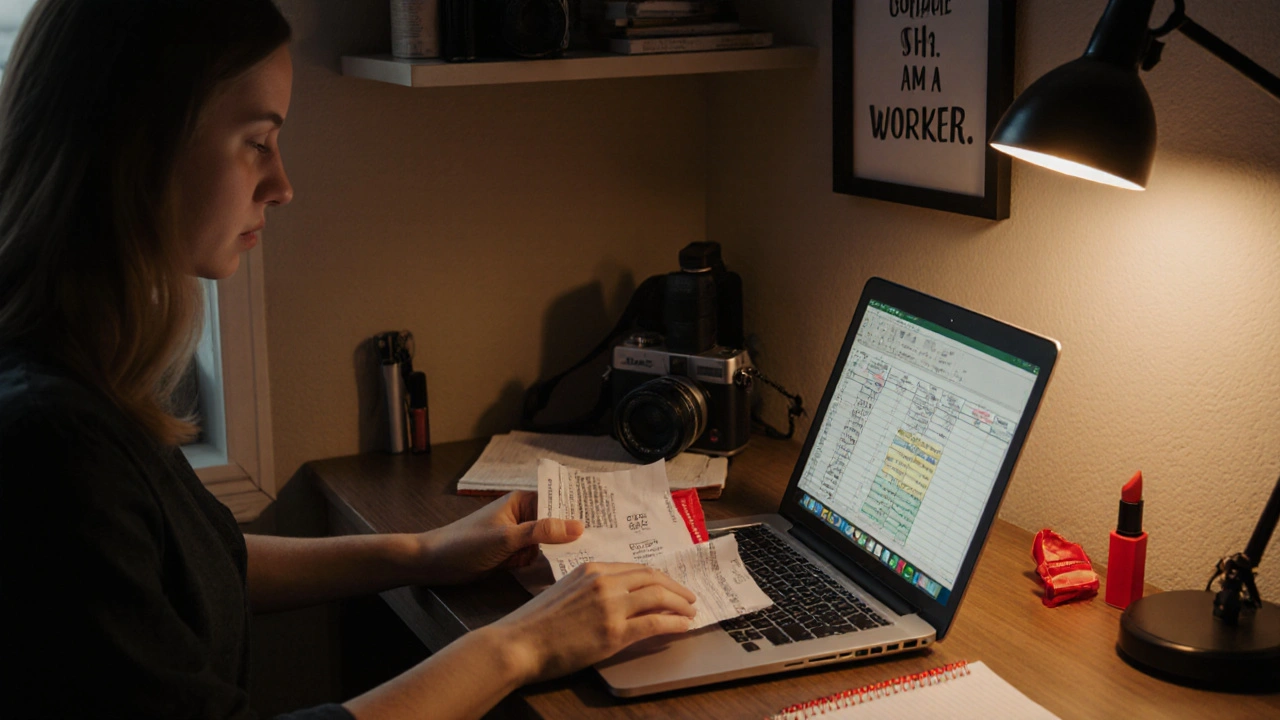

Most people don’t realize that things like rent for a private workspace, internet bills, phone data, cleaning supplies, condoms, and even travel to appointments can count as business costs. You don’t need a fancy office. If you use your bedroom for client meetings, a portion of your rent and utilities can be claimed. If you buy lingerie for work, that’s a deductible item—not a personal expense. The key is keeping simple records: a photo of a receipt, a note in your phone, or a spreadsheet with dates and amounts. You don’t need an accountant to start, but you do need to separate your work costs from your personal ones.

What you can’t claim is anything that’s illegal or personal. You can’t deduct fines, bribes, or payments to avoid legal trouble. But you can deduct costs tied to safety: encrypted apps, security cameras, or even a panic button. These aren’t luxuries—they’re tools of the trade, just like a hairdresser’s scissors or a plumber’s wrench. The self-employed sex worker, an individual who operates independently and reports income from sexual services has the same rights as a freelance photographer or a delivery driver. The tax office doesn’t care what you do, only that you’re honest about what you earn and spend.

Many sex workers avoid filing taxes because they fear judgment or exposure. But the system is designed to protect your privacy—HMRC doesn’t ask how you made your money, only how much and what you spent. If you’ve ever wondered if you’re leaving money on the table, you probably are. One worker we spoke to saved £2,300 last year just by claiming her phone bill and car mileage. That’s not a small amount. It’s rent. It’s groceries. It’s breathing room.

There’s a difference between hiding income and claiming deductions. One is risky. The other is smart. If you’re earning cash, you’re already managing finances. Now you’re just doing it right. Below, you’ll find real stories and practical advice from sex workers who’ve navigated tax season without panic, stigma, or confusion. These aren’t theoretical guides. They’re lived experiences—and they show you exactly how to protect your money, your safety, and your peace of mind.

- Nov, 12 2025

- 0 Comments

Tax Obligations for Sex Workers: Self-Employment, Deductions, and Records

Sex workers in Australia must declare income and can claim business deductions like any self-employed person. Learn how to track earnings, claim expenses, avoid penalties, and protect your rights with proper records.

read more